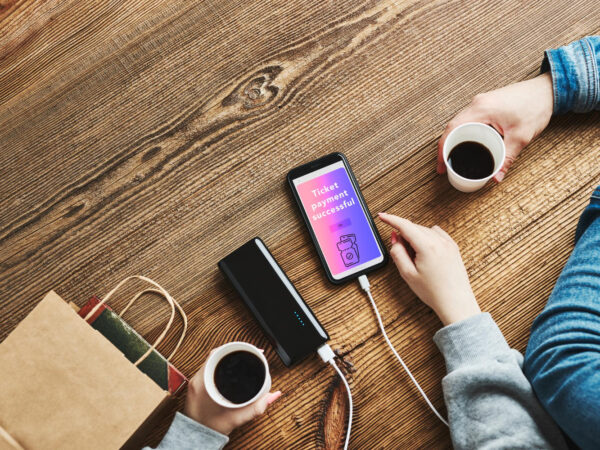

Mobile apps lifehacks 2026: Smarter shopping—price comparisons, filters, and limits to avoid overspending and sneaky subscriptions

Shopping apps in 2026 are designed to make purchasing effortless, and that’s exactly why overspending happens. One-tap checkout, saved cards, “only 2 left” pressure, personalized feeds, and bundles that quietly….